Introduction

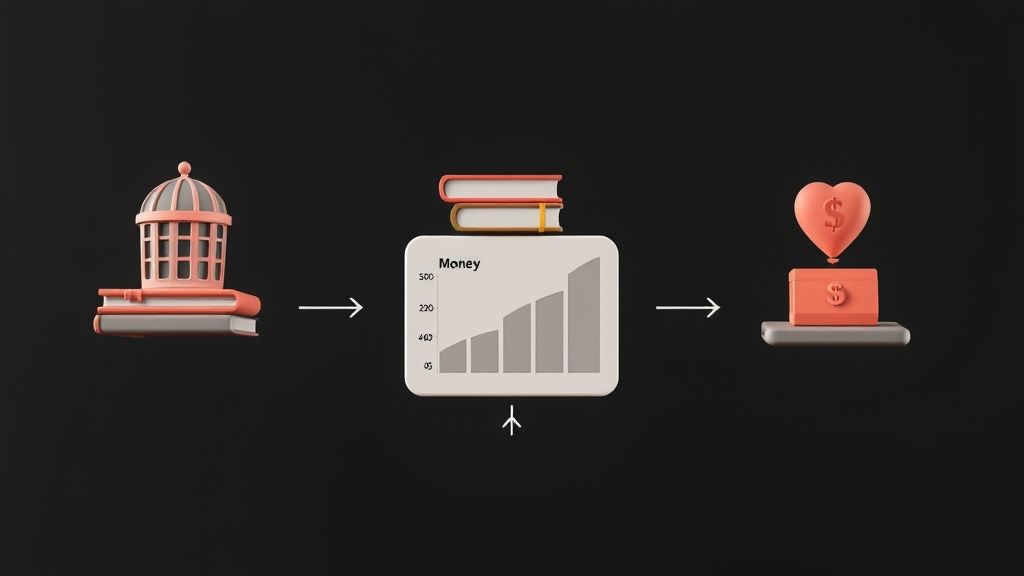

Why do so many people struggle with money—even when they know the “right” thing to do? The answer often isn’t math—it’s psychology. 💡 Behavioral finance is a field that studies how emotions, cognitive biases, and mental shortcuts influence financial decisions. From overspending on credit cards to panic-selling investments, our minds can sabotage wealth-building if we’re not careful.

This article explores how to identify money traps, reprogram harmful beliefs, and build habits that strengthen your financial future. By mastering behavioral finance, you’ll learn how to outsmart your own brain 🧠—turning emotional decisions into rational strategies that create lasting financial security. For more insights, check resources like 👉 Investopedia’s Behavioral Finance Guide.

Step 1: Understand Common Money Biases

Your brain has built-in shortcuts called biases. These were useful for survival in the past but often backfire in today’s financial world. For instance, loss aversion makes us fear losses more than we value gains—leading to missed opportunities. Similarly, herd mentality encourages us to copy others, often fueling market bubbles 📊.

Other biases like overconfidence (believing you can beat the market) and present bias (choosing instant gratification over future rewards) are equally dangerous. Recognizing these traps is the first step toward avoiding them. When you see yourself hesitating out of fear, or chasing trends because “everyone is doing it,” pause and question whether your brain is tricking you. 👉 For a deeper breakdown, see Psychology Today on Biases.

Step 2: Reframe Your Spending Habits

Most spending decisions aren’t logical—they’re emotional 🎯. Retailers know this, which is why impulse buys are placed at checkout lines. To regain control, practice mental accounting by labeling money into specific “buckets” such as savings, bills, and guilt-free fun. This helps reduce the urge to overspend because you’ve already set clear boundaries.

Automation is another powerful weapon. By setting up automatic transfers into savings or investment accounts, you reduce the number of decisions you need to make—protecting you from temptation. Mindful spending also helps: before swiping your card, ask, “Does this purchase bring me closer to or further from my goals?” 👉 Learn practical systems from Ramsey Solutions’ Budgeting Tips.

Step 3: Build Better Investment Behavior

Most investors underperform the market not because of bad investments but because of poor behavior 🧠. Common mistakes include chasing performance (buying “hot” stocks after they’ve peaked), panic selling during downturns, and trying to “time the market” instead of staying invested. These habits cost ordinary investors billions every year.

The solution is to adopt consistent, disciplined strategies. Techniques like dollar-cost averaging and diversification spread risk and reduce the impact of volatility. A long-term perspective shields you from daily market noise and emotional decision-making. 📊 To deepen your knowledge.

Step 4: Harness the Power of Financial Habits

Relying on willpower alone rarely works—habits are far more powerful. Automating good financial behaviors ensures consistency. For example, setting automatic bill payments prevents late fees, while automatic retirement contributions make saving effortless. Over time, these micro-actions compound into huge results 📈.

Apps and tools can help too. Many platforms round up small purchases and invest the spare change, turning loose coins into growing portfolios. By making good financial choices the default option, you save energy for bigger decisions. 👉 Explore apps like Acorns or Mint for practical automation.

Step 5: Align Money With Your Purpose

Money is just a tool—it should serve your bigger goals, not control them. Research shows that people who align spending with personal values report higher happiness 😊. Instead of splurging on material items, prioritize experiences, education, or health—things that bring long-term satisfaction.

Giving also matters. Studies in behavioral finance show that generosity boosts personal well-being. Even small donations or acts of financial kindness provide fulfillment beyond personal consumption. Aligning money with your purpose turns wealth-building into a deeply meaningful journey. 👉 Check resources like Giving What We Can for impact-driven giving ideas.

Step 6: Avoid Common Money Pitfalls

Even the most disciplined savers can fall into traps. Lifestyle inflation—spending more as you earn more—is a common one. Without boundaries, higher income can disappear as quickly as it comes in. Another mistake is delaying savings with the thought, “I’ll start later,” which sacrifices the power of compounding ⏳.

Hidden fees also erode wealth silently. From mutual fund expenses to credit card charges, ignoring small costs can hurt long-term growth. Finally, letting fear or greed dictate investment timing can destroy portfolios. Staying aware of these pitfalls ensures your financial journey stays smooth. 👉 See practical warnings from The Motley Fool.

Frequently Asked Questions (FAQs)

Q1. What is behavioral finance?

It’s the study of how psychology influences financial decisions—helping us understand and correct money mistakes.

Q2. How do emotions affect investing?

Fear often triggers panic selling, while greed encourages overtrading. Both can hurt long-term performance 📉.

Q3. Can I train myself to be better with money?

Yes ✅. By practicing awareness, automating habits, and having accountability partners, you can improve steadily.

Q4. Why do most people fail at budgeting?

They view it as restriction. Reframe budgeting as aligning money with your values and priorities, not deprivation.

Q5. What’s the #1 behavioral finance tip?

Consistency beats perfection. Automate good habits and let time and compounding do the heavy lifting.

Conclusion: Outsmart Your Own Brain

💡 True financial mastery is less about IQ and more about emotional intelligence (EQ). 🧠 By understanding your biases, building systems that support good habits, and aligning your money with purpose, you can overcome emotional traps and achieve long-term wealth. 🚀 Outsmart your brain, and your finances will finally work for you—not against you.