Introduction

Wealth is more than just money in your account—it represents security, freedom, and legacy. True wealth allows you to enjoy life without the constant fear of financial setbacks. But here’s the reality: wealth doesn’t appear overnight. It’s built slowly, consistently, and strategically.

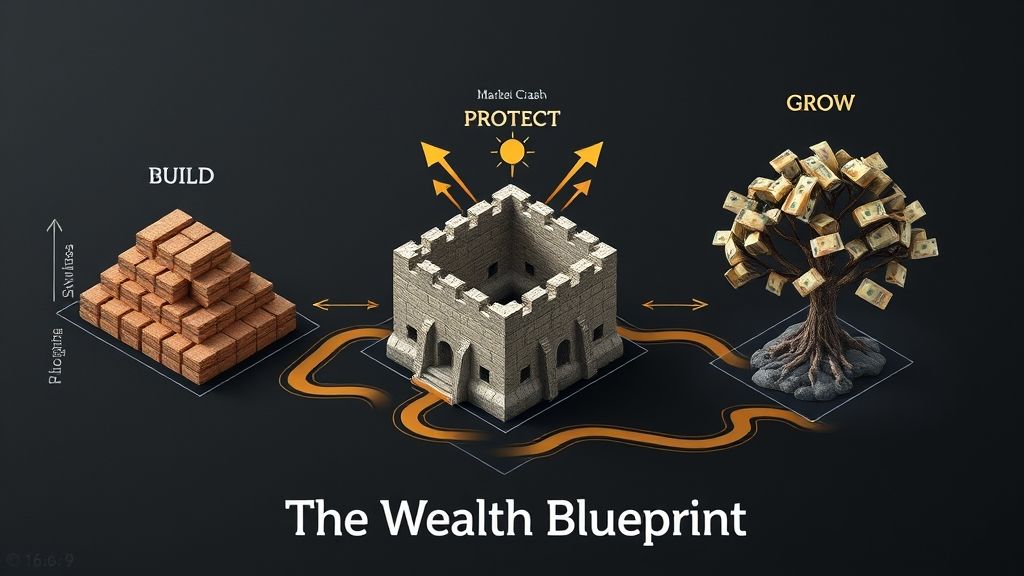

This wealth blueprint provides a structured path: first you build a solid financial foundation, then you protect your assets, and finally you grow your money strategically. Along the way, we’ll highlight proven strategies, practical examples, common mistakes, and resources to deepen your knowledge.

Step 1: Build a Strong Financial Foundation

Just as skyscrapers rely on strong foundations, wealth requires a stable base. Without it, even high earnings can crumble under debt or poor planning.

1. Create a Purpose-Driven Budget

Budgeting often gets a bad reputation as a restrictive or joyless exercise, but in reality, it’s a powerful tool for designing the life you want. A purpose-driven budget doesn’t just track numbers—it gives every dollar a role in helping you achieve your goals. Think of it as a roadmap: each expense should move you closer to what truly matters. For instance:

Make your budget work for your goals. If travel excites you, set aside funds regularly so trips are fully funded. If owning a home is your priority, save for a down payment and adjust spending as needed. Connecting your budget to your aspirations turns money management into a strategy for living your best life.

50% Essentials: Half your income goes to must-haves like rent, groceries, utilities, and transport.

30% Lifestyle: For dining out, subscriptions, travel, hobbies, and entertainment learn more about lifestyle budgeting.

20% Growth: Savings, investments, or debt payments. Small, consistent contributions grow into long-term financial security.

Think of it as a modern blueprint: you take care of today’s needs, enjoy life in the moment, and steadily invest in tomorrow—all in one balanced plan.

Think of it as a modern blueprint: you take care of today’s needs, enjoy life in the moment, and steadily invest in tomorrow—all in one balanced plan.

Pro Tip

Use free tools like Mint or YNAB to automate tracking and stay on course with your budget. These apps make it easy to monitor spending, set goals, and manage your finances without stress.

2. Build an Emergency Fund

Unexpected financial shocks—like sudden medical bills, a job loss, or urgent car repairs—can throw even the best budgets off track. That’s why having an emergency fund is crucial. Ideally, this fund should cover 6–12 months of essential expenses, giving you a safety net when life surprises you. For example, if your monthly essentials cost $2,000, having $12,000–$24,000 set aside can help you handle emergencies without going into debt. Start building your fund gradually using tools like Mint or YNAB to track your savings progress and stay on course.

Example:

What if you lose your job? Instead of borrowing money at high credit card interest rates, your emergency fund can help you cover expenses and stay financially safe without going into debt.

Read Complete Emergency Fund Article

3. Manage Debt Wisely

Not all debt is bad—taking a mortgage to buy a home or a student loan to invest in your education can actually help you build wealth over time. However, high-interest debt, like credit cards or payday loans, can quickly spiral out of control and eat into your savings. For example, if you carry a $5,000 credit card balance with a 20% interest rate, you could end up paying hundreds of dollars just in interest each month. To manage and reduce high-interest debt, consider using budgeting and tracking tools like Mint or YNAB, which help you plan payments and stay on top of your finances.

Two proven strategies:

- Debt Snowball → Focus on paying off your smallest debts first. This gives you quick wins and keeps you motivated.

- Debt Avalanche → Focus on paying debts with the highest interest first. This helps you save money in the long run.

Read Complete Debt Management Article

Step 2: Protect What You’ve Built

After building your base, protecting it is essential. Without protection, one lawsuit or illness could erase years of effort.

1. Insurance: Your Wealth Shield

Health Insurance: Medical emergencies can be financially devastating, and health insurance helps you avoid high medical bills or bankruptcy. Whether it’s routine check-ups or unexpected hospital visits, having coverage gives peace of mind. Explore plans from top providers like ICICI Lombard or HDFC ERGO.

Life Insurance: Life insurance ensures your loved ones are financially secure if something happens to you. It can cover living expenses, debts, or future education costs. Leading providers include Axis Max Life Insurance (formerly Max Life) :contentReference[oaicite:0]{index=0} and ICICI Prudential Life Insurance :contentReference[oaicite:1]{index=1}.

Property & Auto Insurance: Protect your home, car, and other valuable assets from damage, theft, or accidents. Coverage ensures that unexpected costs don’t derail your finances. Check options from top insurers like Bajaj Allianz Motor Insurance :contentReference[oaicite:2]{index=2} or Bajaj Allianz General Insurance :contentReference[oaicite:3]{index=3}.

Disability Insurance: If you can’t work due to illness or injury, disability insurance replaces a portion of your income so you can continue covering expenses. This protection helps maintain your lifestyle even during tough times. Consider plans from providers like Tata AIG or SBI Life Insurance.

2. Tax Planning

Understand Your Taxes: Taxes can significantly impact your wealth if not managed properly. In India, knowing your tax obligations and staying updated with rules is key. You can access official information and track your income tax filings at the Income Tax Department.

Maximize Tax-Saving Investments: Utilize instruments like the Public Provident Fund (PPF), Employee Provident Fund (EPF), National Pension Scheme (NPS), and Equity Linked Savings Schemes (ELSS) to save taxes under Section 80C and others. Proper planning ensures you reduce taxable income while growing your wealth.

Track Deductions & Gains: Keep a record of eligible deductions such as business expenses, charitable donations, home office costs, and health insurance premiums. Favor long-term capital gains for investments, as they are taxed at lower rates. Tools like ClearTax can help you file returns, generate tax reports, and optimize your tax strategy efficiently.

Example:

Earning $90k? Contribute $20k to a 401(k), taxable income drops to $70k, saving thousands.

Read Complete Tax Optimization Article

3. Estate & Legacy Planning

Wealth planning should extend beyond you. Without a plan, heirs face taxes and court battles.

Estate planning is essential to ensure your assets and wishes are handled properly. A Will clarifies how your assets should be distributed after your passing, while a Trust helps avoid probate and can minimize taxes for your heirs. Additionally, a Power of Attorney allows you to assign someone to make important financial or medical decisions on your behalf in case of emergencies, ensuring your affairs are managed according to your wishes.

Read Complete Insurance Planning Article

Step 3: Grow Your Wealth

After securing your finances, the next step is to grow them wisely through smart investing.

1. Compounding Power

Compounding is truly your wealth’s greatest ally. The earlier you start investing, the more time your money has to grow exponentially. Just like a snowball rolling down a hill, your investments can gain momentum over time, accumulating interest on both your initial principal and the returns it generates. This simple yet powerful principle can turn modest, consistent contributions into a substantial financial nest egg over the years.

Example:

Invest $500 monthly (~₹40,000) at 7% annual return: Start at 25 → $1.2M (~₹9.6 crore) by 65. Start at 35 → $565k (~₹4.5 crore). See your potential growth with our Investment Calculator!

2. Diversify Investments

To grow your wealth, consider diversifying your investments across different avenues. Stocks and ETFs offer potential for long-term growth, while Bonds provide stability and steady income. Real Estate can generate rental income and appreciate over time, and Side Businesses can create additional cash flow. Combining these options helps balance risk and maximize returns over the long run.

3. Passive vs Active Investing

When it comes to investing in the stock market, you can choose between Passive options like index funds and ETFs, which are low-cost and offer consistent returns, or Active strategies such as trading and stock picking, which carry higher potential rewards but also greater risk. Combining these approaches based on your goals and risk tolerance can help optimize your portfolio.

4. Retirement Planning

Start early to retire comfortably:

For retirement planning, consider multiple avenues to secure your future. Options include employer-sponsored 401(k) plans or pensions, IRA or Roth IRA accounts, and annuities that provide guaranteed income. Diversifying across these retirement vehicles can help ensure financial stability during your later years.

Read Complete Retirement Planning Article

Step 4: Adopt the Wealth Mindset

Mindset drives money habits:

When it comes to building lasting wealth, consistency is more important than intensity, as small, regular steps often outperform occasional big efforts. Always think long-term, focusing on growth over decades rather than quick gains in days. Continuously learning through books, podcasts, and mentors helps you make smarter financial decisions. Finally, giving back ensures your wealth serves a purpose beyond money, helping you leave a meaningful legacy.

Step 5: Avoid Wealth-Destroying Mistakes

One common financial mistake is lifestyle inflation, where you increase your spending as your income grows, leaving little room for savings or investments. Another pitfall is speculative investing, chasing “get rich quick” trends without a solid strategy, which can lead to significant losses. Many people also make the error of ignoring taxes, missing opportunities for tax optimization and deductions that could boost their wealth. Finally, not having a retirement plan and relying solely on government pensions can leave you unprepared for the future, emphasizing the importance of proactive financial planning.

Frequently Asked Questions (FAQs)

Q1. How much should I save before investing?

Build at least 3–6 months of living expenses in an emergency fund before starting regular investments. This creates a financial safety net.

Q2. Is all debt bad?

Not all debt is bad. Productive debt like mortgages or business loans can help grow wealth. But high-interest debt should be paid off as quickly as possible.

Q3. What’s best for beginners?

For beginners, low-cost index funds or ETFs are ideal. They are diversified, simple to manage, and have lower fees compared to actively managed investments.

Q4. How to beat inflation?

Invest in assets that typically outpace inflation, such as stocks, real estate, or inflation-protected bonds. Consistent investing over time helps protect purchasing power.

Q5. What’s the #1 money mistake?

The biggest mistake is lack of planning. Without a financial blueprint, it’s easy for money to slip away through unnecessary expenses or poor investment choices.

Conclusion: Your Wealth Blueprint Starts Now

Building lasting wealth doesn’t happen by chance—it requires a deliberate approach that combines careful planning, disciplined saving, smart investing, and proactive protection of your assets.

By understanding your financial goals, creating a clear strategy, and consistently reviewing your progress, you can avoid common pitfalls such as lifestyle inflation, speculative investments, or ignoring tax planning.

Taking control of your finances empowers you to make informed decisions, secure your family’s future, and enjoy financial freedom. Adopt the right mindset, embrace continuous learning, and implement practical strategies that align with your long-term objectives.

Over time, these actions compound, helping you not only grow your wealth but also achieve peace of mind, confidence, and the freedom to live life on your terms. Start today, stay committed, and let your wealth blueprint guide you toward a secure and prosperous future.