Introduction

Traveling is exciting, but unexpected events can disrupt even the best-planned trips. Travel insurance is your safety net, covering medical emergencies, trip cancellations, lost luggage, and more.

This guide provides insider tips to select the right travel insurance. From understanding policy types to assessing coverage, we’ll help you make informed choices to travel with peace of mind.

Step 1: Assess Your Travel Risks

Before choosing a policy, evaluate potential risks based on your destination, activities, and health conditions.

1. Understand Destination Risks

Different countries have different medical costs, security concerns, and natural disaster risks. Research your destination thoroughly to determine the level of coverage you need.

2. Activity-Based Coverage

If you plan on adventure sports or extreme activities, ensure your insurance policy explicitly covers them. Standard policies may exclude high-risk activities.

3. Health Considerations

Pre-existing conditions may affect coverage. Disclose all relevant health information to avoid claim denial. Some insurers offer supplemental coverage for high-risk conditions.

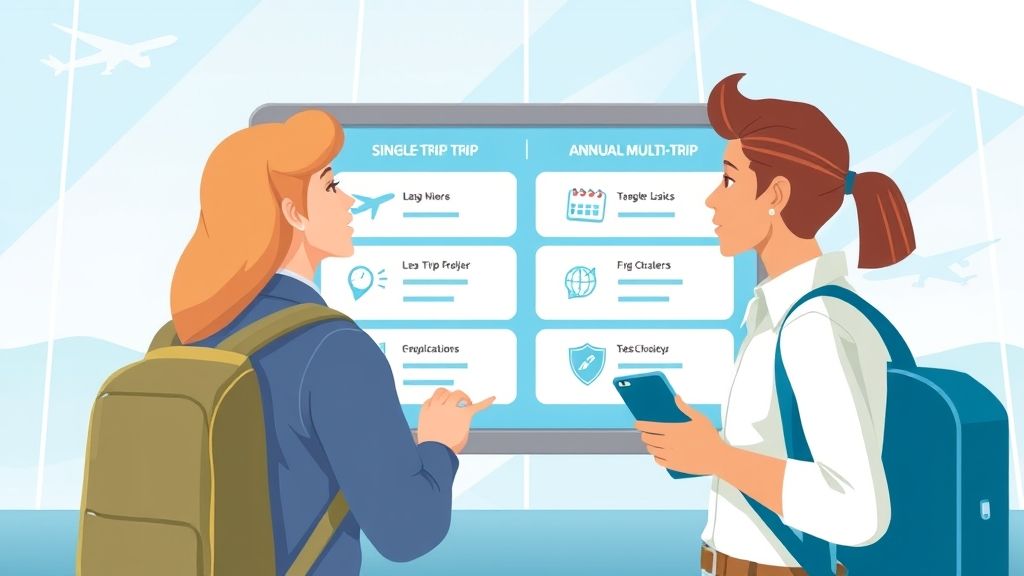

Step 2: Choose the Right Policy Type

Travel insurance comes in various forms. Selecting the right type ensures coverage for your unique needs.

1. Single-Trip vs Annual Multi-Trip

Single-trip insurance covers one journey, while multi-trip policies protect multiple trips in a year. Frequent travelers often save with annual coverage.

2. Comprehensive vs Basic

Comprehensive policies cover medical emergencies, trip cancellation, lost luggage, and more, whereas basic policies may offer minimal coverage. Consider your risk tolerance and budget when selecting.

Step 3: Read the Fine Print

Understanding policy terms is crucial. Pay attention to exclusions, claim procedures, and limits.

Step 4: Optimize Coverage vs Cost

Balance between affordability and sufficient protection. Don’t compromise essential coverage for lower premiums. Compare multiple providers and use online tools to evaluate policy options.

Step 5: Tips for Filing Claims

Keep all receipts, medical reports, and proof of incidents. Report claims promptly and follow insurer instructions carefully to ensure smooth processing.

Frequently Asked Questions (FAQs)

Q1. Is travel insurance necessary for domestic trips?

While optional, it provides peace of mind for medical emergencies, cancellations, or lost belongings even within your country.

Q2. Does travel insurance cover COVID-19?

Coverage varies. Check if medical, quarantine, and cancellation policies explicitly include COVID-19-related incidents.

Q3. Can I buy insurance after booking a trip?

Yes, but some benefits, like cancellation coverage, may be reduced. Purchase as early as possible.

Conclusion: Travel Safe with Confidence

Choosing the right travel insurance ensures your trips are safe, enjoyable, and worry-free. Assess risks, pick appropriate policies, and keep documentation handy for smooth claims. Travel smart, stay protected, and enjoy every journey.